- Back

- Board

-

Departments

- 911

- Animal Services

- Arts

- CDBG Program Office

- Communications

- Community Development

- Courts

- Economic Development

- Elections and Voter Registration

- Emergency Management

- Financial Management Services

- Fire

- Maps (GIS)

- Human Resources

- Information Technology Services

- Internal Audit

- Keep Cobb Beautiful

- Library

- Medical Examiner

- Neighborhood Safety

- Parks and Recreation

- Police

- Procurement Services

- Public Safety

- Public Services

- Recreation

- Safety Village

- Senior Services

- Support Services

- Tax Assessor

- Tax Commissioner

- Transportation

- Water

- Water Education

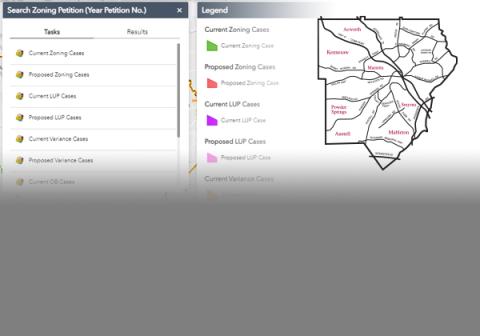

- Zoning

- Courts

- iCOBB